Setup Automatic postings

ExFlow | Setup | Resources | Setup for automatic postings

Setup for automatic postings is a general settings form for ExFlow automatization processes.

| Buttons (action pane) | |

|---|---|

| Save | Save |

| Options | Standard D365FO menu |

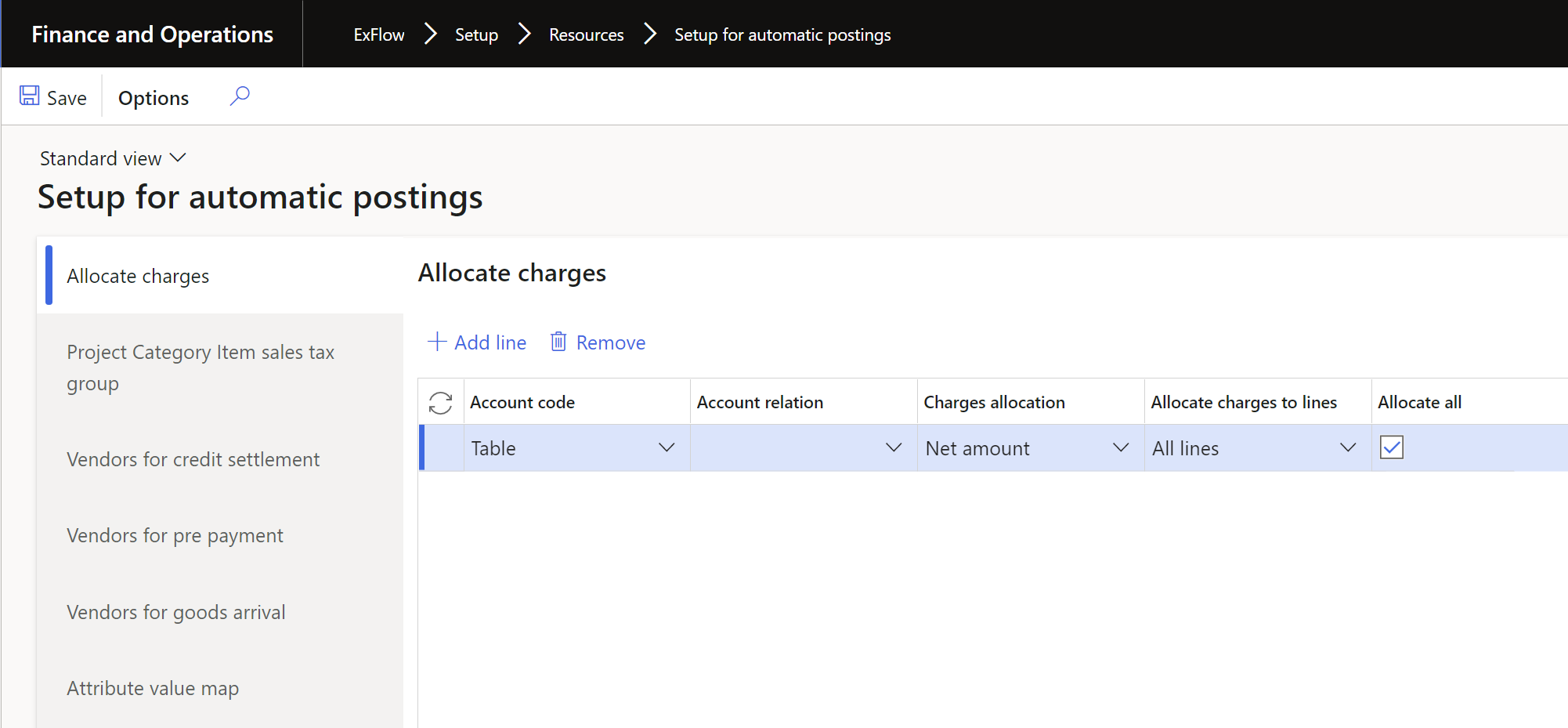

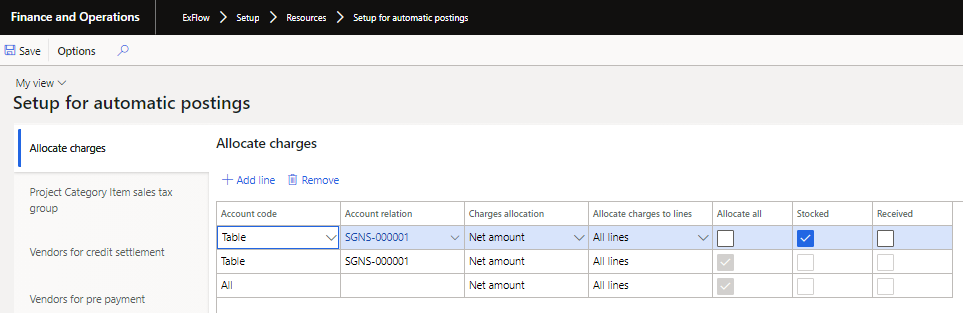

Allocate charges

Allocate charges are used when purchase order invoices are posted without having the user to manually choose the allocation. It is also now supported to work with batch posting of purchase order invoices that has allocated charges.

| Allocate charges | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. |

| Charges allocation | Type of allocation to be used. |

| Allocate charges to lines | Type of allocation to per line. |

| Allocate all | If the amount should be allocated over all items. |

| Stocked | If the amount should be allocated over stocked items. |

| Received | If the amount should be allocated over received items. |

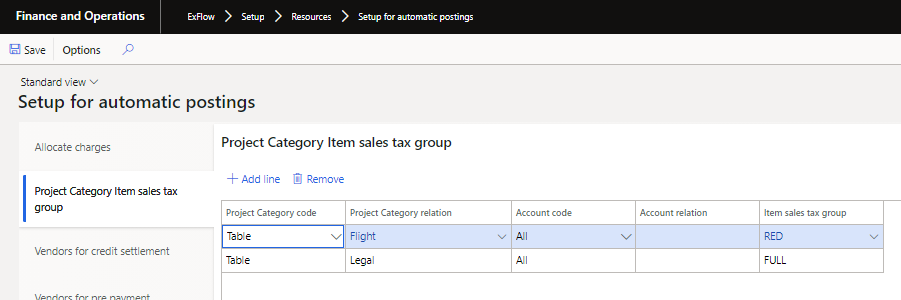

Project Category Item sales tax group

Project category item sales tax group is used to automatically choose an Item sales tax group in based on a project category.

| Project Category Item sales tax group - fields | |

|---|---|

| Project category code | Choose between All, Table or Group |

| Project category relation | Choose the desired category relation. |

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. |

| Item sales tax group | Set the Item sales tax group that shall be used. |

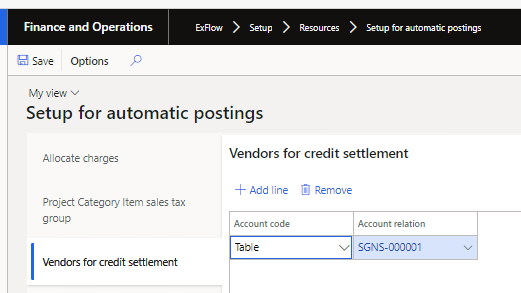

Vendors for credit settlement

Vendors for credit settlement is used if the ExFlow parameter "Authorized vendors only" is enabled in ExFlow parameters, prepayment, and settlement tab to only work with specified vendors.

| Vendors for credit settlement | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. |

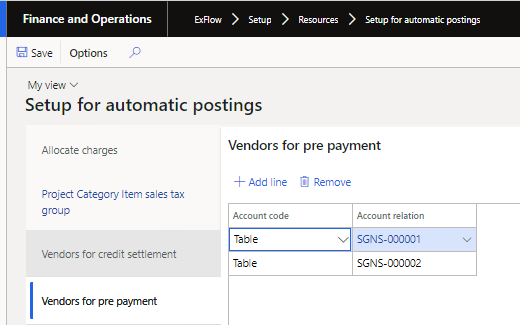

Vendors for pre payment

Vendors for pre payment is used if the ExFlow parameter "Authorized vendors only" is enabled in ExFlow parameters, prepayment and settlement tab to only work with specified vendors.

| Vendors for prepayment | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. |

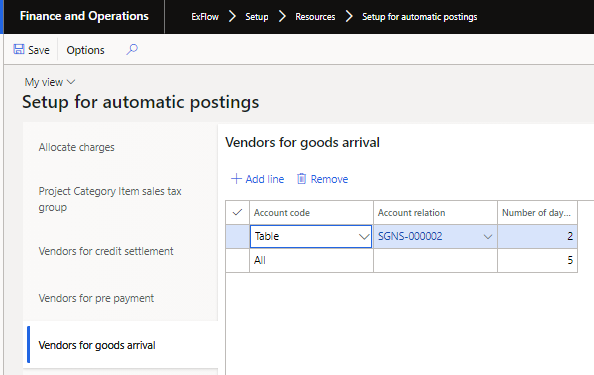

Vendors for goods arrival

The function vendors for goods arrival are used for invoices that are put on hold when they are posted from ExFlow import form and has a quantity variance. This is the same function that exists in ExFlow parameter form however this setting will support to setup individual rules based on for example vendor. Meaning when the batch job "Auto match purchase order invoices on arrival of goods" is run and try to rematch the invoice or if not possible send out the invoice for manual handling to an approver. The batch job will look in this setup to see if any unique rules for that vendor is configured.

| Vendors for goods arrival | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. See the below section for setting up ExFlow approval groups. |

| Number of days before system release of quantity variance invoices | Number of days that the batch job triggers on before an invoice that is set on hold is released for manual approval. |

See more details under Setup and use of purchase order invoice on arrival of goods:

https://docs.exflow.cloud/finance-operations/docs/user-manual/accounts-payable-process/process-of-purchase-order-invoices/setup-and-use-of-purchase-order-invoice-on-arrival-of-goods

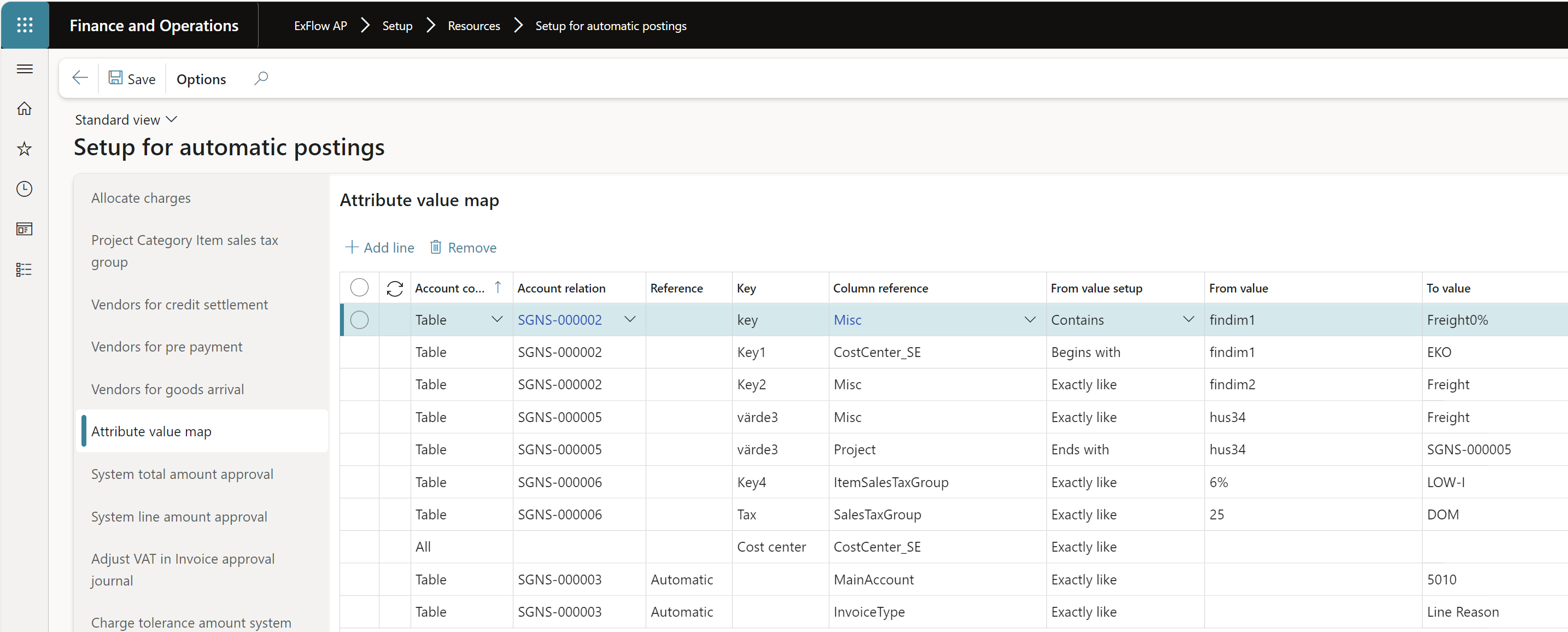

Attribute value map

Attribute value map is used to setup tags that are read from the imported XML file that holds line level data for cost account invoices such as ledger accounts, dimensions, charges (misc.) and tax settings etc. To use this functionality, contact Truvio or your partner for further discussions on how to configure the XML file that is used for import invoice data.

| Attribute value map | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. See the below section for setting up ExFlow approval groups. |

| Reference | Reference |

| Key | The name of the tag in the XML file. |

| Column reference | The destination field in D365FO (the fields that are setup in ExFlow columns for the current company, e.g. project, cost center or misc). |

| Pass–through | If checked the raw data from the XML file is sent directly to the destination field. |

| From value setup | Priority setup for finding values. When importing an invoice with line attributes, the priority is to find value for: 1. "Exactly like" setup - value is exactly the same as in "From value" field. 2. "Begins with" - value starts with the same character as in "From value" field. 3. "Ends with" - value ends with the same character as in "From value" field. 4. "Contains" - value contains characters as in "From value" field. 5. "Pass through" - blanks out the "From value" and "To value" fields and sends the raw data from the XML file directly to the destination field. |

| From value | If the value in the XML file is the same it is triggering a translation to the value in the "To value field", see below. |

| To value | The value that will be set in the destination field based on the from value. |

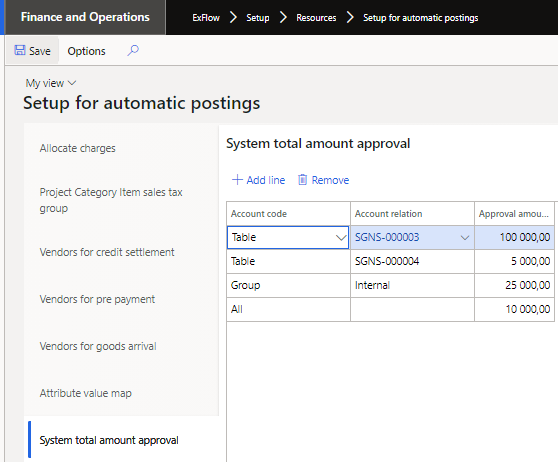

System total amount approval

System total amount approval replaces the setting in ExFlow parameters, purchase order tab "Max total amount. The benefit of this setup is that unique settings can be made for different vendor or vendor groups if an automatic approval should be made or not depending on the approval amount.

| System total amount approval | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. See the below section for setting up ExFlow approval groups. |

| Approval amount | The approval amount that are allowed for an automatic approval of a matched purchase order invoice should take place. |

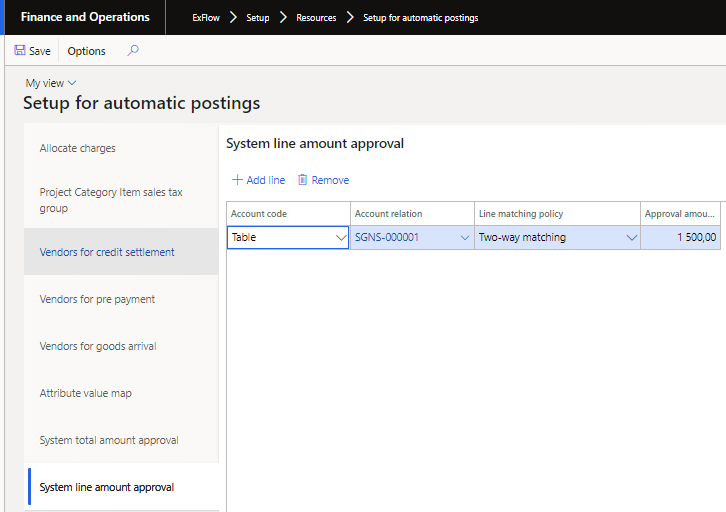

System line amount approval

System line amount approval replaces the setting in ExFlow parameters, purchase order tab "Max line amount". The benefit of this setup is that unique settings can be made for different vendor or vendor groups if an automatic approval should be made or not depending on the approval amount and matching policy.

| System line amount approval | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. See the below section for setting up ExFlow approval groups. |

| Approval amount | The approval amount that are allowed for an automatic approval of a matched purchase order invoice should take place. |

| Line matching policy | Choose if the rule should apply for two-, three-way matching or not required. If not required is setup without zero amount the result will be that all invoices with matching policy will be sent out for manual approval. |

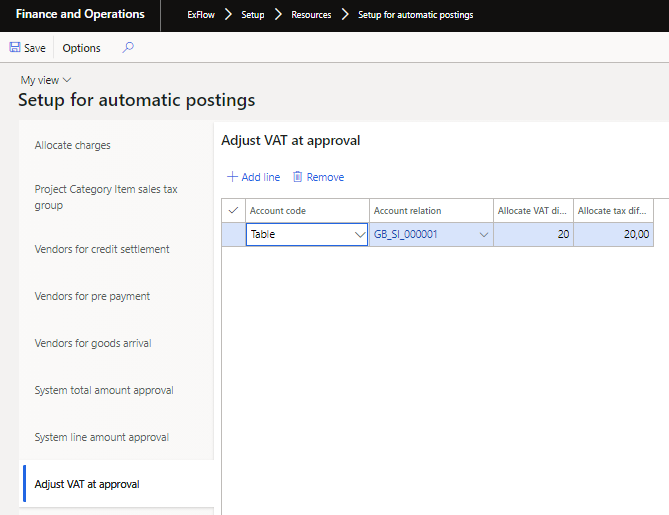

Adjust VAT in Invoice approval journal

Adjust VAT at approval gives the possibility to define the limits for adjusting VAT per supplier, supplier group or for all suppliers. This will override the setting in ExFlow parameters, sales tax tab "Allocate VAT difference if less than(percent)" and "Allocate tax difference if less than (amount)".

| Adjust VAT at approval | |

|---|---|

| Account code | Choose between All, Table or Group. |

| Account relation | Choose specific vendor/group depending on settings in account code. See the below section for setting up ExFlow approval groups. |

| Allocate VAT difference if less than (percent) | Enter the maximum VAT difference that is allowed to be allocated in percent. |

| Allocate VAT difference if less than (amount) | Enter the maximum VAT difference that is allowed to be allocated in amount. |

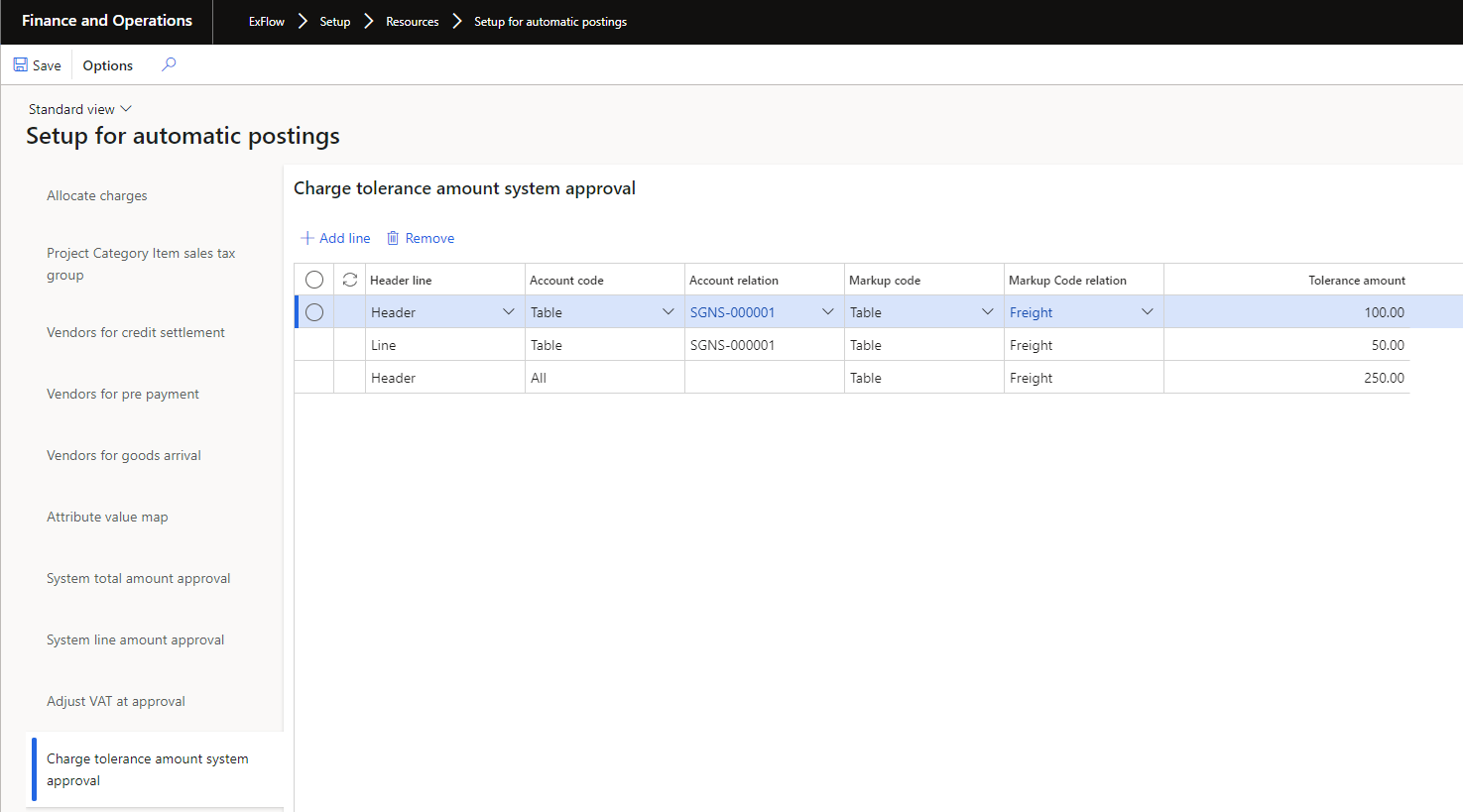

Charge tolerance amount system approval

This form is used to set tolerance amount per charge type and determines if a line charge should be system approved or sent out for manual approval.

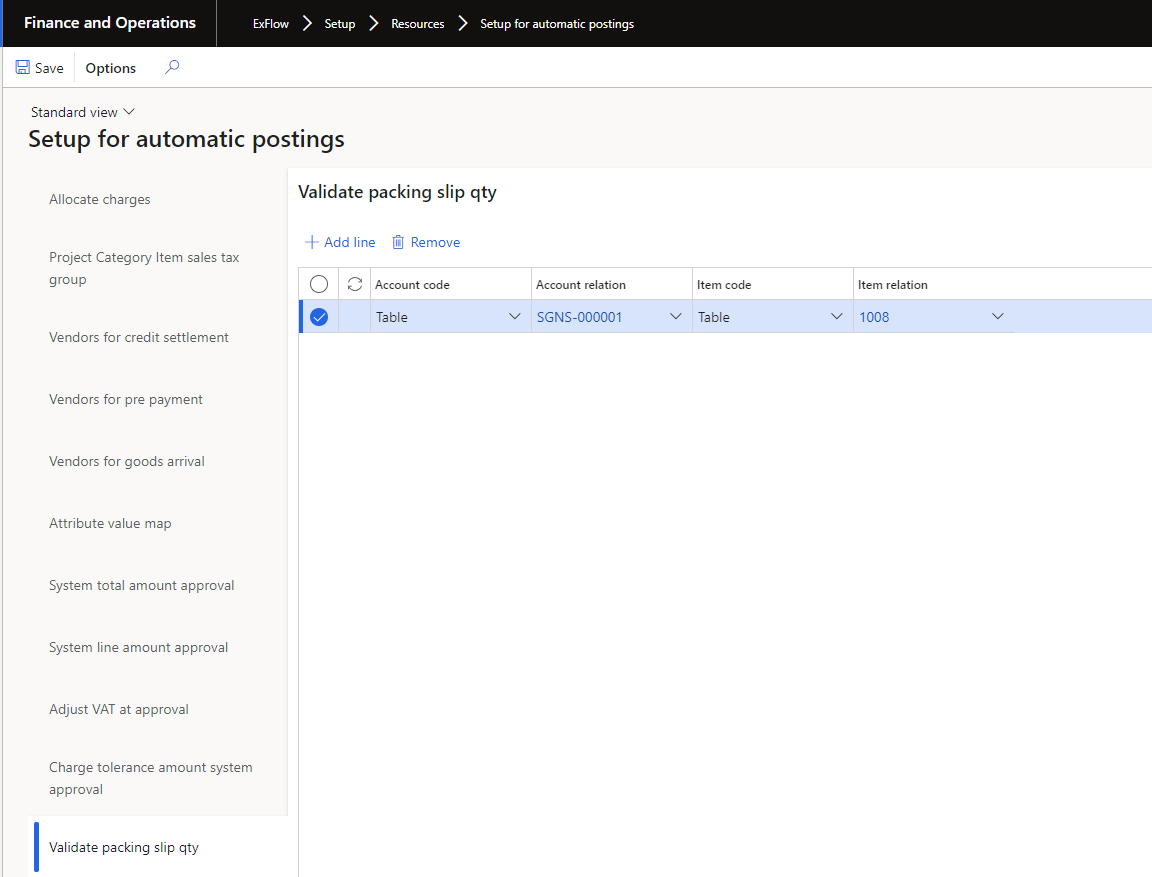

Validate packing slip qty

This form is used to select vendors in conjunction with items, for which packing slip connection should be applied.

See more information in documentation for packing slip setup.

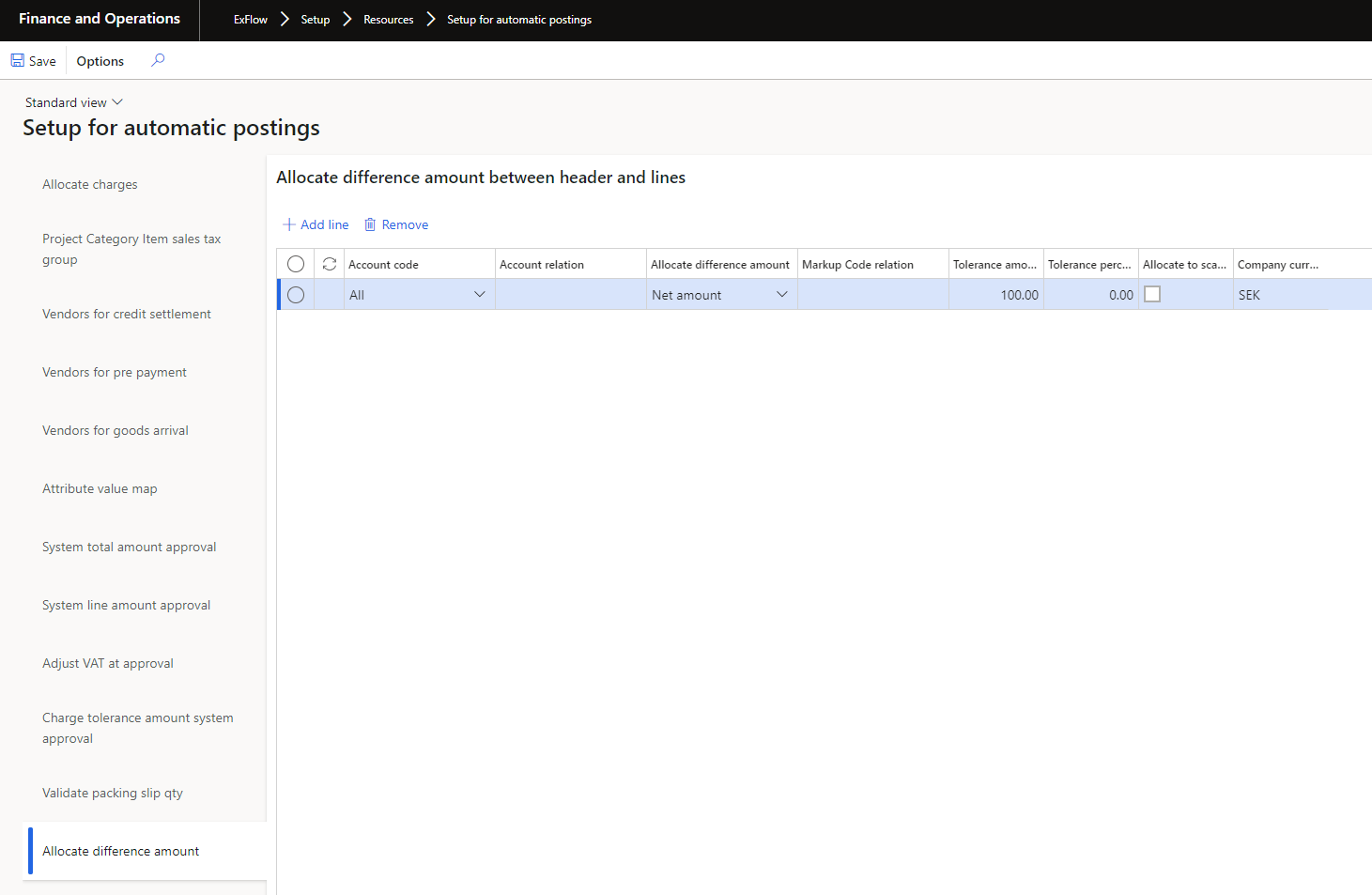

Allocate difference amount (between header and lines)

This functionality splits difference between header and line amounts on to lines based on the selected proportion type.

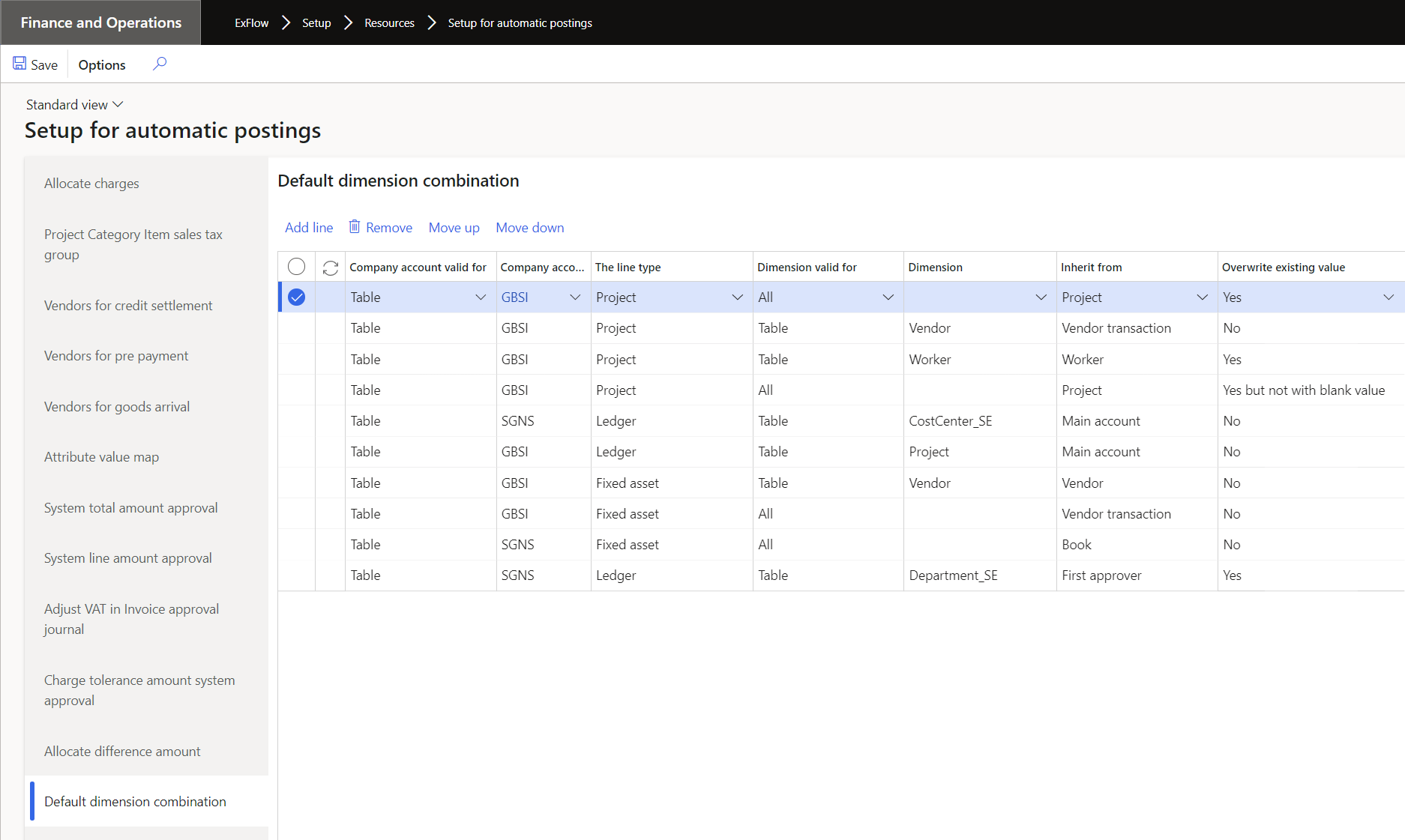

Default dimension combination

This form is used to set default dimensions on invoice lines based on rules created.

*Please note that this is a global functionality.

Due date calculation

This functionality is designed to enhance flexibility by allowing organizations to define due dates based on specific business rules, rather than applying a uniform due date derived from standard system parameters.

When the validation logic is enabled, the system verifies that the due date on the document in the import form matches the due date generated by the calculation logic during invoice validation or posting. This ensures that the invoice is issued with the due date defined by the rules engine.

If the due date does not comply with the calculation rules, a warning or error - depending on the selected option in the dropdown - is displayed and handled according to standard procedures.

If no entries exist in the setup for automatic posting under calculation rules, the validation process is skipped. See Exflow parameters | Posting logic https://docs.signupsoftware.com/finance-operations/docs/user-manual/get-started/parameters#posting-logic.

When entries exist in the new calculation rules under “Setup for automatic posting,” the system disregards the previous parameters related to due date calculation and applies the new calculation rules instead.

If no entries exist, the legacy logic remains in effect. The date selected in the “Starting point” field determines the reference date from which the due date calculation is performed.

Exflow | Setup | Parameters | Import

Enable the functionality in ExFlow parameters.

Exflow | Setup | Resources | Setup for automatic postings | Due date calculation

Define the specific rules for due date calculation.

| Due date calculation | |

|---|---|

| Company account valid for | Choose between All or Table. |

| Company accounts | Select a specific company account depending on the setting in company account valid for column. |

| Import method valid for | Choose between All or Table. |

| Import method relation | Select an import method depending on the setting in import method valid for column. |

| Account code | Choose between All, Table or Group. |

| Account relation | Select the specific vendor/group depending on settings in account code. |

| Invoice type | Choose between All, Cost or Purchase order invoices. |

| Credit debit selection | Choose between Both, Credit or Debit. |

| Starting point | Choose between Scanning date, Posting date or Invoice date. |

| Due date calculation method | Select one of the calculation methods. See description of each method in the below column. |

| Include PO | When enabled – calculation method considers the due date from PO and not from vendor card. |

| Due date calculation methods | |

|---|---|

| Scanned due date | Scanned due date is picked from import history field „Due date“. |

| Calculated due date | Due date is calculated from starting point date + days set on the vendor terms of payment. |

| Cash discount date | Due date is calculated from starting point date + days set on the vendor cash discount field. |

| Earliest due date | Earliest due date of two is picked: Scanned due date and Calculated due date. |

| Earliest date including cash discount | due date of three is picked: Scanned due date, Calculated due date and Cash discount date. |

| Latest due date | Latest due date of two is picked: Scanned due date and Calculated due date. |

| Latest date including cash discount | Latest due date of three is picked: Scanned due date, Calculated due date and Cash discount date. |

| Todays date | Due date is set as the date when invoice was imported to import form. |

Example

Exflow | Setup | Resources | Setup for automatic postings | Due date calculation

Vendor Card:

Exflow | Inquiries and reports | Import history

Once imported, the earliest due date including cash discount is calculated:

Note: If Payment Date is set on the vendor it will be prioritized.

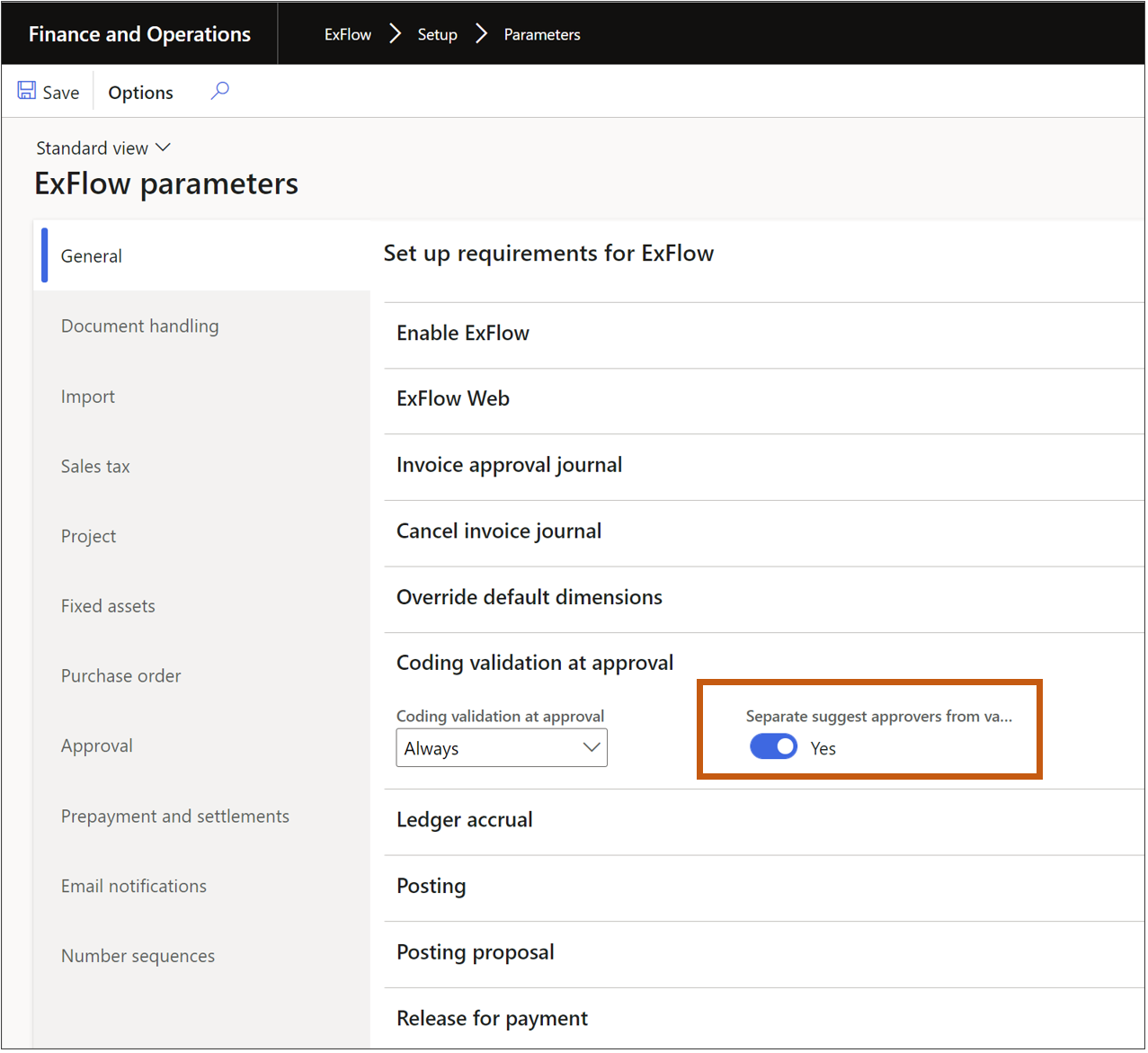

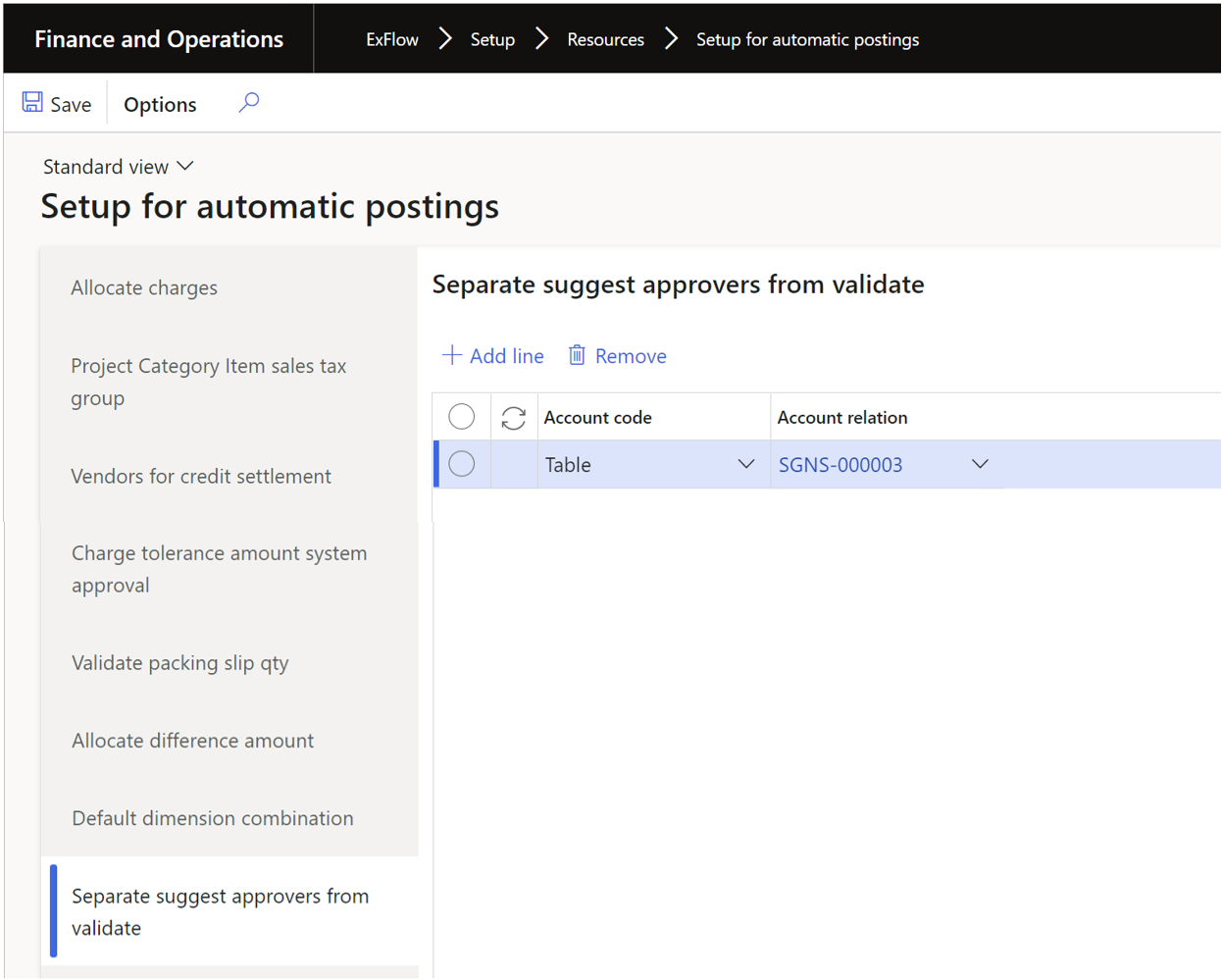

Separate suggest approvers from validate

Approving invoices in the external web can take a long time. This is most often due to the "suggest approver" functionality, that is when the system tries to create a new approval chain using advanced logic.

The purpose of this solution is to speed up the handling of invoices in the external web. The solution makes it possible to run the "suggest approver" logic separated from validation when using the web app.

ExFlow | Setup | Parameters| General

To turn on the logic a record must be present in;

ExFlow | Setup | Resources| Setup for automatic postings| Separate suggest approver from validate. In the account code you can use Table, Group or All.

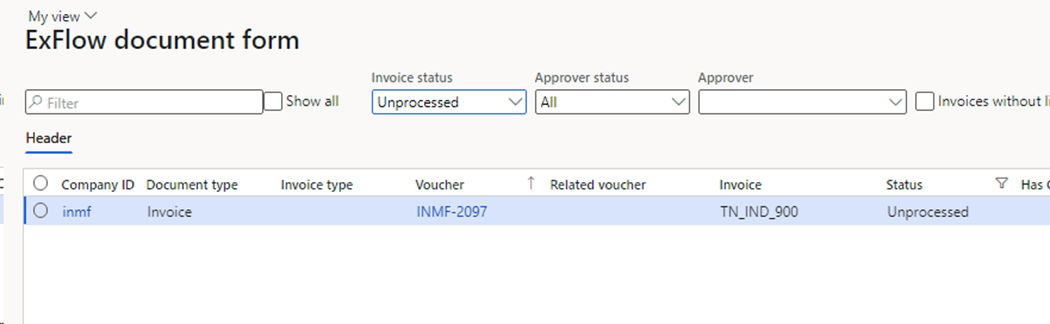

When the user approves invoice lines in the external web, information is written in tables in D365FO so the system will know which lines will be handled at a later stage. If this is the last line to be approved, the invoice status is set to "Unprocessed".

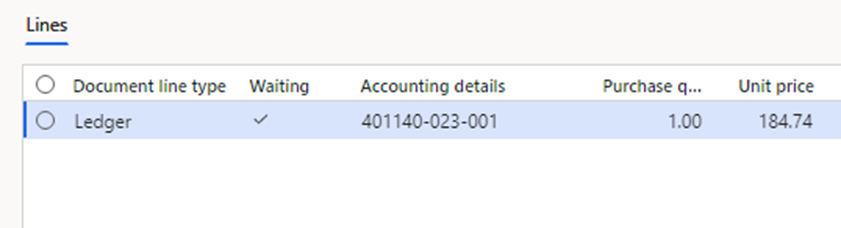

Every line that is to be run in the "suggest approver" (see below) has been marked with status "Waiting" in the two forms that show ExFlow invoices (Document table list page and Document table).

Navigate to: Exflow | Periodic tasks | Miscellaneous | Suggest approvers after validate.

Once approved the dialog - the invoice status changes to Approved.